Compare the options between Self Employed or Limited Company:

Sole Trader or Limited Company?

The question we’re asked more than any other is, should we be a sole trader or a limited company?

The answer always depends on your personal circumstances and choice, however, we would always recommend checking with your accountant before making such a decision and weigh up all the pros and cons before deciding which business structure is best for you.

Two key factors you should consider before deciding on your business structure:

Limited liability

Limited liability basically means the debts and liabilities belong to the company, the company is a separate legal entity in its own right.

Your trusted partner for business information and accountancy

Tel: 0191 695 7648 Email: info@acfbusiness.co.uk Web: www.acfbusiness.co.uk

As a sole trader if there are not sufficient assets to cover the liabilities, then your personal assets could be used to cover the shortfall, yes that could mean your house!

Tax savings

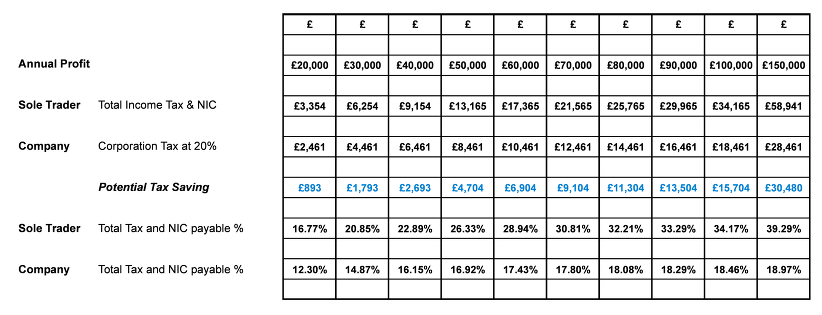

Limited companies will pay corporation tax on their profits of 20% (up to £300,000).

Profits would be extracted by way of small salary and dividends, which are not subject to national insurance.

A sole trader will pay:

Class 2 national insurance of £2.70 per week

Income tax on profit over your personal allowance

Class 4 national insurance of 9% on profits over £7,755 to £41,450 and 2% thereafter.

Click the arrow to down load the comparison table as a PDF

We’ve heard it said that the savings made in tax would be negated by increased accountancy fees, if that’s the case then you’re with the wrong accountant!

Sole Trader v Limited Company

2013 / 2014